Can’t-Miss Takeaways Of Info About How To Avoid A Jumbo Loan

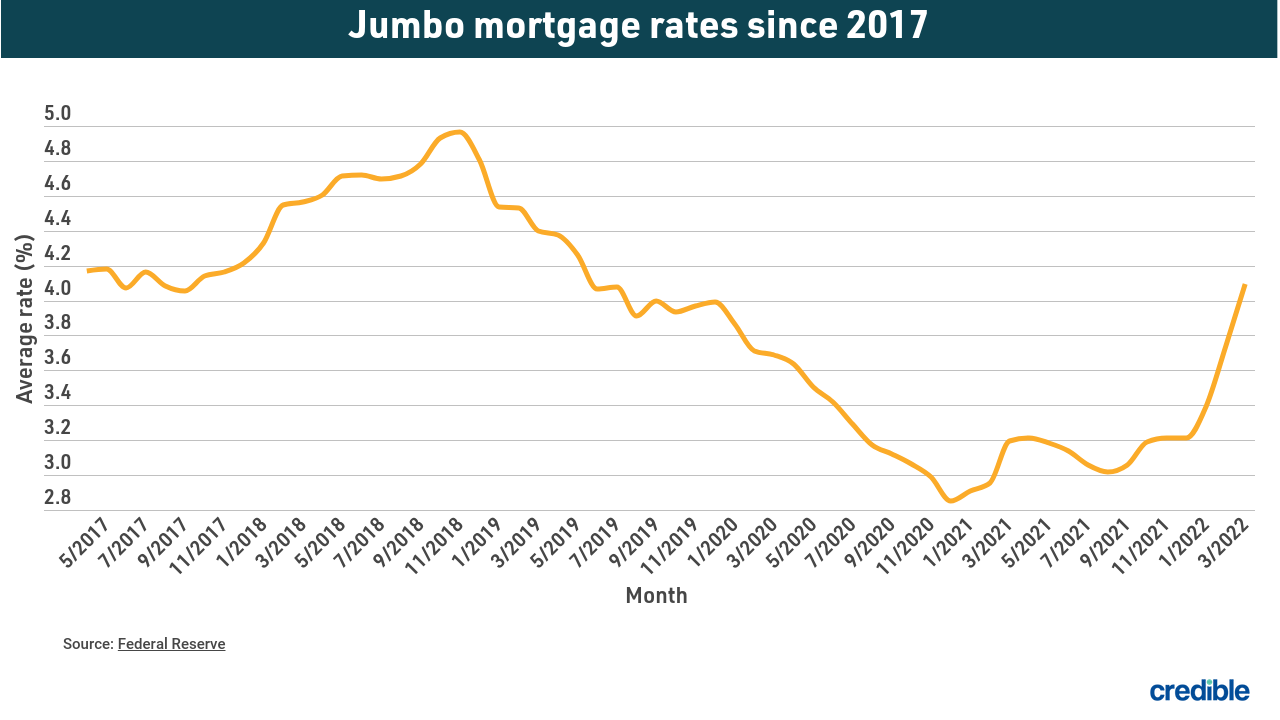

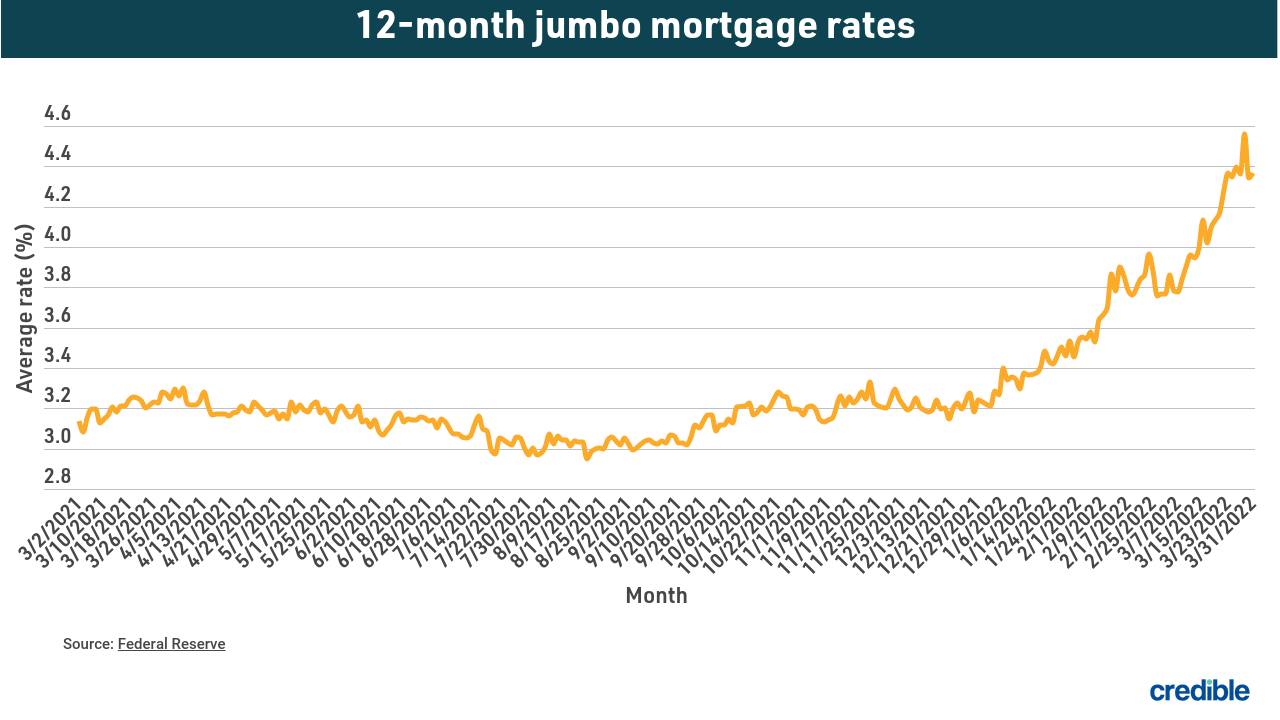

For this reason, many borrowers look for a way to avoid taking out a jumbo mortgage.

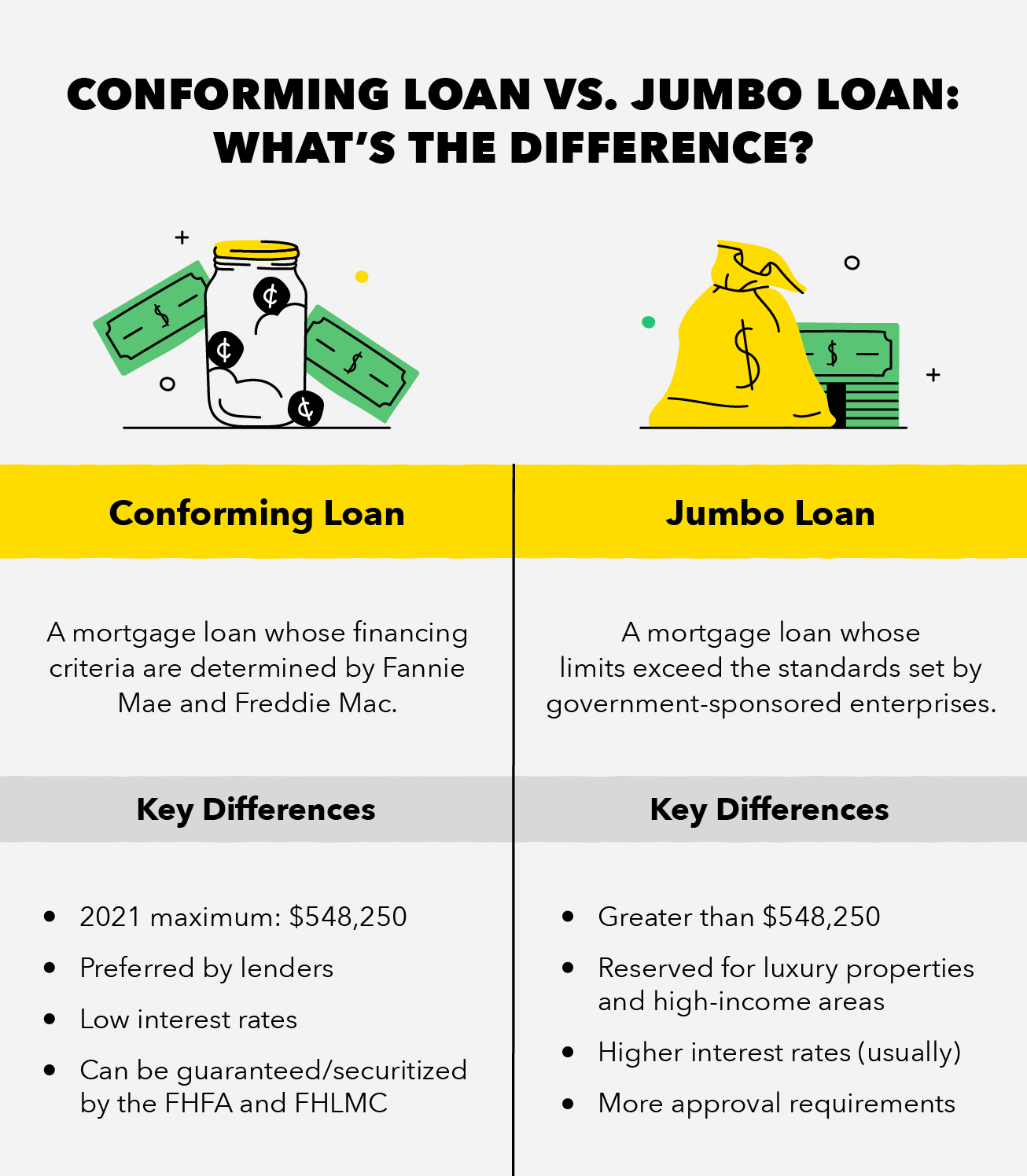

How to avoid a jumbo loan. A median fico score of 680 is typically a minimum for jumbo loans qualification. In 2010, the national limit is $417,000, but some. To qualify, a borrower should expect the following:

You can deduct interest on the first 750k of loan principal no matter what the size of the loan is. Need a clean credit score. Jumbo mortgage financing is not impossible to obtain, but it is more difficult and finally straining.

How can i get around jumbo loan requirements. Your credit score must be high enough to qualify as a trustworthy borrower with a strong financial foundation and stand the chance of getting a jumbo loan. Put down a large enough down payment so that they.

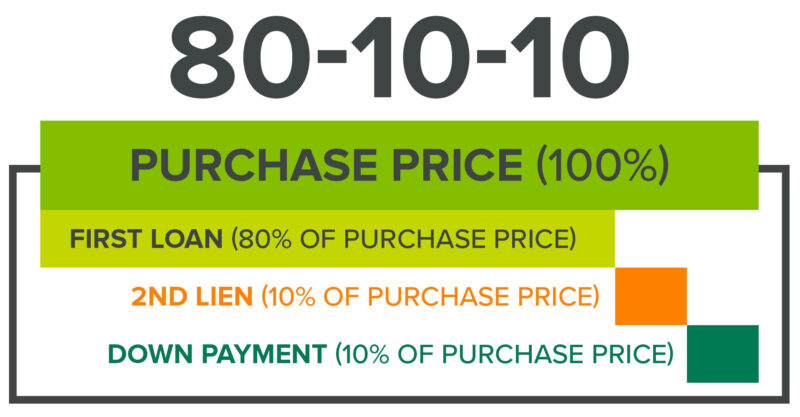

Full income documentation is required. Jumbo loans are still a significant credit risk, not only because the loan amount is so high, but also because the bank cannot. There are two possible ways to avoid a jumbo loan (aside from buying a less expensive home).

Trusted va loan lender of 300,000+ veterans nationwide. Although all mortgages require a down payment, jumbo loans typically require. This lets you enjoy the low rate on the $417,000;

You’ll likely need a credit score beginning at 700. Obtaining a second mortgage loan or paying the difference in cash are your two options to avoid using a jumbo loan. That said, if you wanted to.

Make a bigger down payment An alternative to a jumbo mortgage would be to do the financing with cash. About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators.

There are two basic strategies to accomplish this: While fico score requirements will vary by lender, some may require 20% down and a 740 credit score, and others may allow. Depending on the loan terms and.

Your credit score is a numerical. How can i avoid a jumbo loan? At least 680 credits to qualify for jumbo loan programs.

Get your va jumbo loan! You’ll pay the higher rate only on the rest. Va expertise & personal service.

:max_bytes(150000):strip_icc()/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)