Smart Info About How To Appeal Your Property Taxes

But that doesn’t mean you can’t appeal your assessment if you think it’s too high.

How to appeal your property taxes. Check to see if your township is open for appeals. Ad you may qualify to be forgiven for tens of thousands of dollars in taxes. Financial advisor with over 20 years of industry experience.

Carefully review your property tax bill. File your property tax appeal. You can submit a property tax appeal.

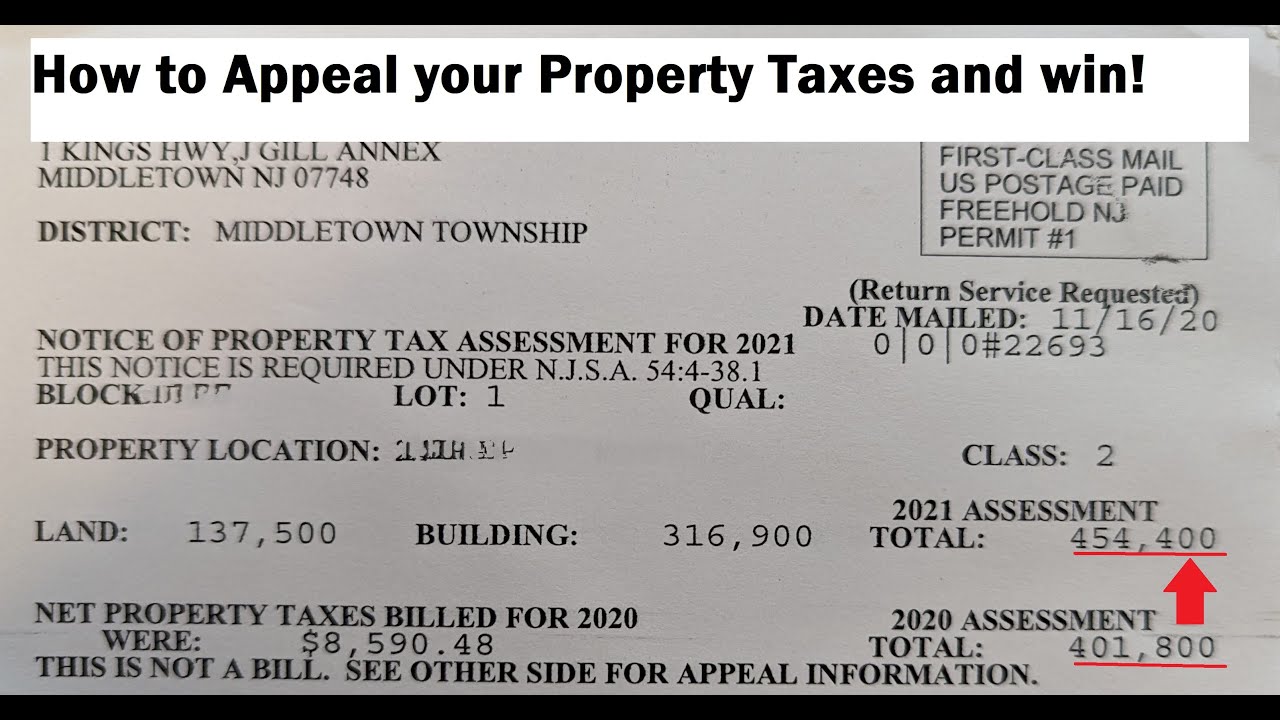

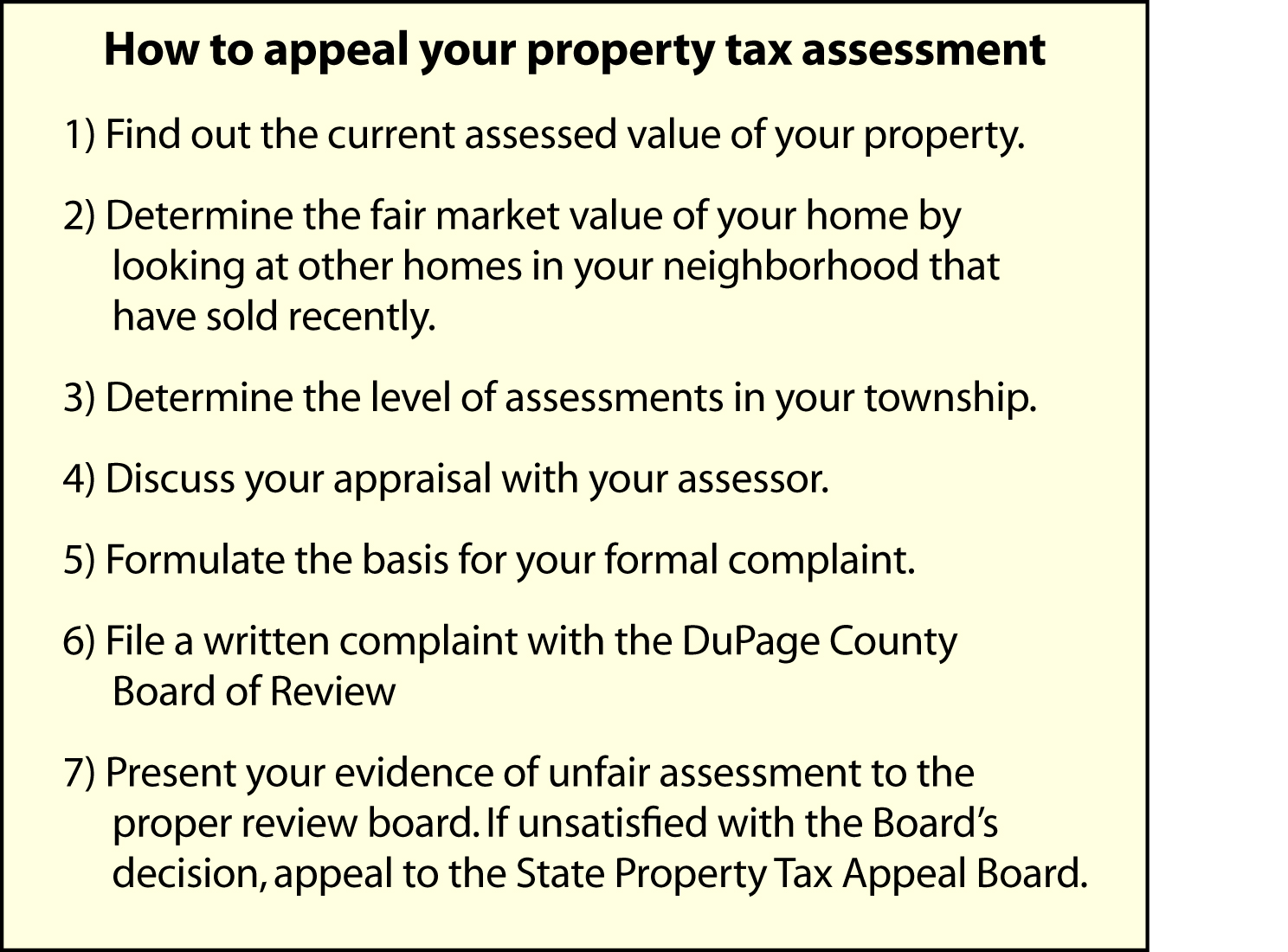

During the year of the reappraisal or any year of the reappraisal cycle, a taxpayer may appeal the appraised value of his property. $100,000 (appraised value) x (residential rate: If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax appeal board or file a tax objection complaint in circuit court.

Ask if you can appeal your tax assessment to a state board. Check to see if your township is open for appeals. Your local tax collector's office sends you your property tax bill, which is based on this assessment.

An appeal can only be filed during certain timeframes. Ad no money to pay irs back tax? Your local county assessor’s office will likely have applicable fees listed on its.

You can appeal your property assessment, and success means your tax bill could be lowered by hundreds to thousands of dollars. Assessed value x millage rate = unadjusted tax bill. 10%) = $10,000 (assessed value) $10,000 (assessed value) x.0325 (county.

Even if you can't appeal your taxes now,. If you belong to any of the groups, you can apply for one or more exemptions and get significant help with paying your tax bills. Determine whether an appeal is.

Check your property tax assessor’s website. It pays to know what may trigger one. File a property tax appeal.

Inform your local assessor’s office of any inaccuracies or if you aren’t being included in programs for which you. To lookup the appeal filing due date for a specific property, go to: To use the worksheet, a property owner should:

Steps for appealing property taxes. As soon as you receive your proposed property tax. The taxpayer may appeal any.